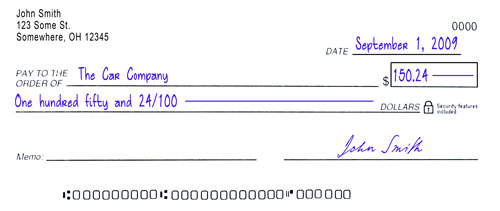

HOW TO WRITE A CHECK

The first time writing a check can be a little overwhelming. Don’t worry, it’s all really simple once it’s all laid out for you. Here are steps on how to correctly write a check, so the payment is effective and it can’t be altered in case it ends up in the wrong hands.

1 - Enter the date and payee

Write the date you are writing the check. If you need the payee to wait until a certain day to cash the check, write that date, this is called postdating and is used to prevent a check from bouncing if you know you won’t have sufficient funds.

Be sure to find out the correct name (personal or business) to write in the "Pay to the Order of" line. If you don’t know, just ask. Avoid writing “cash” as this will make it easier for the wrong person to cash the check.

2 - Write the numeric form of the amount to be paid in the box provided

Place this number as far to the left as possible to prevent someone from adding extra numbers in front. Draw a line through the remaining space so extra numbers can’t be placed at the end.

3 - Write out the word form of the amount to be paid on the line that ends with the word "DOLLARS"

Simply spell out the dollar amount, the word "and," and the cents in fraction form (for example, $10.67 would read: "Ten and 67/100"). Begin as far to the left on the line as possible so a fraud won’t be able to fill in a higher dollar amount. After the cents, draw a line down to the word "DOLLARS" so nothing can be added to the left over space.

4 - On the bottom right-hand line, sign your name

You should use the signature that the bank has on file. This will make it easier for the bank to recognize if someone other than you signed the check.

5 - For your own records, you can write the purpose of the check on the bottom left line marked "MEMO" or "FOR"

Some payees might require that you write something in the memo line, such as an account number for a service provider, or an address for your landlord.1

1 Pritchard, Justin. "A Visual Example of how to Write a Check." About.com.2009. Web. 2 Sept 2009.

The information contained in all articles, links, sponsored articles, questions within this website does not necessarily represent the views of Abbey Credit Union and its affiliates. This website is designed to offer helpful hints to consumers. Please consult an attorney, CPA, or other professional for expert advice.

24/7 OttoTeller Access

Make account inquiries, transfers, withdrawals, and more... anywhere and anytime (24 hours a day, 7 days a week) over the telephone. Abbey's Response Telephone Banking Service offers a Toll Free Telephone Number for your convenience. Local 937-898-0281 Toll Free 800-222-3989.